Crypto is an evolving industry. There are usually a number of narratives or trends that captures everyone’s attention for a while before the next story comes along. The trend that we’re looking at in this issue is Bitcoin staking.

Traditionally, Bitcoin is not known as a yield-generating asset. It mostly sits quietly in a cold wallet, waiting to be sold one day by its owner. Since Bitcoin is a Proof-Of-Work type of blockchain network, the coin itself can’t be used to secure the network, nor is this needed. If the owner wanted to use it to generate some kind of yield, the only option available is to “move” the BTC using bridging to lend it out to others and get yield that way.

Currently, new advancements allow for Bitcoin to be staked to secure other networks(?!) and earn yield for doing so. The total value locked for staked Bitcoin is around $9 billion, with $5.4 billion locked up in the Babylon protocol alone. A year ago, there was less than $1 billion locked up. For context, the market value for Bitcoin is $2.3 trillion at the time of writing.

Before we look into how this works, the question we should also ask ourselves is: does Bitcoin need to earn yield?

Perhaps the idea of Bitcoin earning yield stems from our traditional understanding of cash earning its keep through bank deposits to beat inflation. We all know that investing into assets is the only way to protect the value of cash, which is being depleted day after day after day. It could also be why you hold Bitcoin, if you see it as an asset. Even without putting it to work, its very existence, like a house, rises in value from you doing nothing.

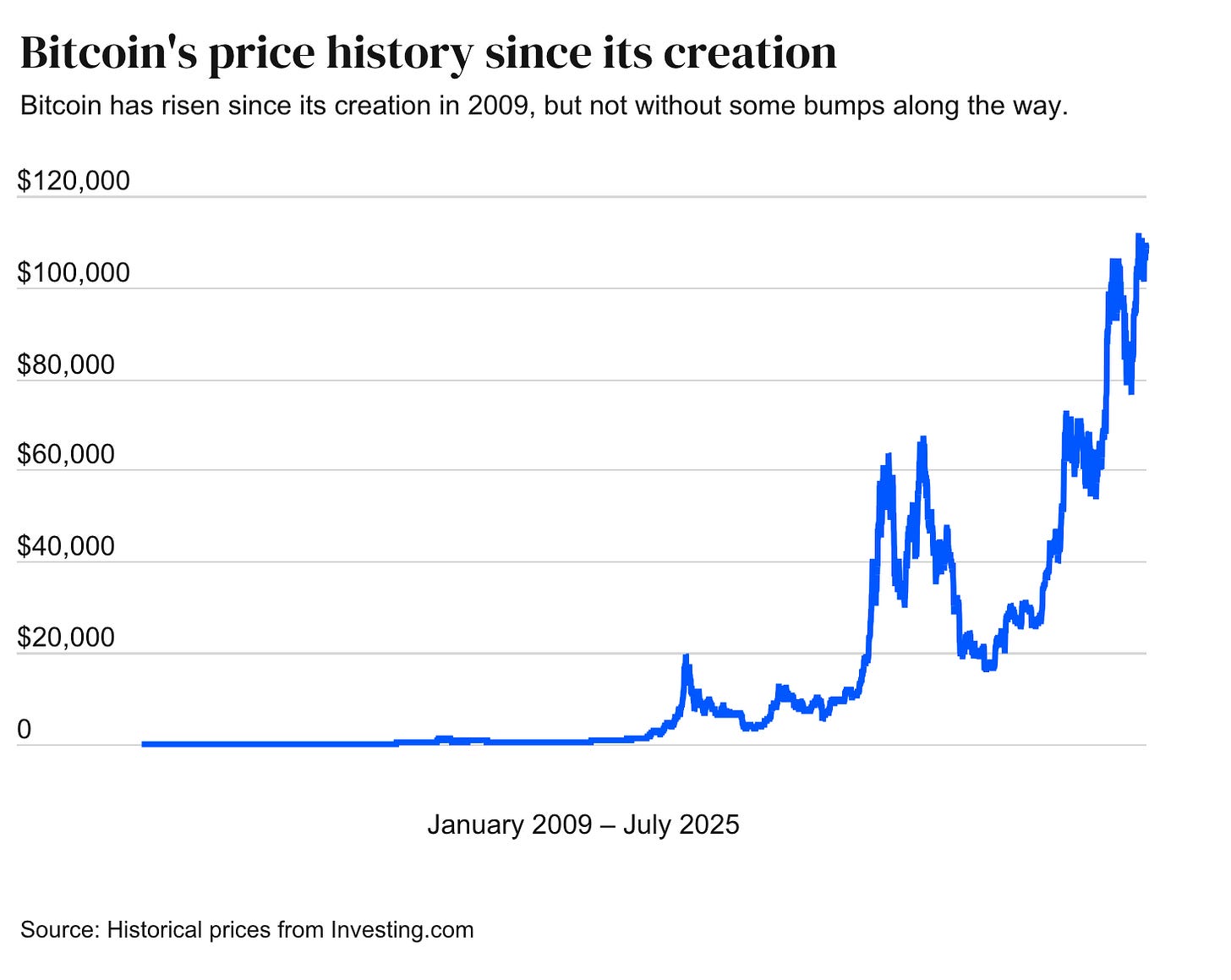

From the picture above, it’s clear that holding Bitcoin safely is more than enough to safeguard its value.

However, if you still have that nagging feeling of Bitcoin sitting there is a bit of a waste, there are now ways for you to scratch that itch. The following options are listed in order of lowest to highest risk.

Staking Bitcoin: Centralised Exchanges

Many centralised exchanges offer to help you earn yield with your Bitcoin by depositing it with them. They then turn around and lend it to others with interest, and share that interest with you, minus their commission.

This option is the easiest to do and carries the lowest risk. While it’s true that you are giving up custody of your Bitcoin by depositing it into an exchange (and that is a risk in itself!), it all boils down to the reliability of the exchange in handling your BTC. Celsius and FTX are some of the reasons why you wouldn’t want to consider this option.

I rated this as a low risk option because there is only one element you need to worry about, which is the exchange. The business model for generating yield is a straightforward one and differs little from your money sitting in a bank.

Staking Bitcoin: Decentralised

Wrapped BTC

As briefly mentioned above, one of the earliests ways for Bitcoin holders to earn yield is to swap the BTC coin for a ERC-20 version of it and use those to interact with the DeFi protocols, mostly found in Ethereum-based blockchains. The tokens are known as wrapped BTC (wBTC).

There are three types of risks involved:

(a) the custodian holding onto your original BTC. This entity mustn’t run away with your assets and always be ready for you to redeem your BTC when you want to.

(b) not lose the wBTC on hand. This is the only way you can redeem your BTC when you’re done with your DeFi experiments.

(c) smart contract bugs / platform issues. Be careful which platforms you interact with as hackers are quick to take advantage of any flaws in smart contracts. If that happens, hope that the platform has the decency (and funds) to compensate you for your loss.

Stacks

Another flavor of the “stake BTC to earn rewards” narrative is the Stacks protocol. What’s interesting about this project is that it’s pretty much another layer built on top the Bitcoin network and it allows smart contracts to interact with the Bitcoin network. This also means that all transactions on Stacks are directly secured by the Bitcoin network.

Instead of staking BTC on the Stacks network, users stake STX, the Stacks native token to earn yield paid out in BTC. The BTC actually comes from the Stacks miner who pay BTC to be chosen as a leader and earn STX from the network. This is the Proof-of Transfer consensus mechanism pioneered by the Stacks team.

Recently, the Stacks team issued sBTC, a 1:1 BTC-backed token that can be used for DeFi activity on the Stacks blockchain. You can obtain this by swapping your BTC to sBTC, then swap it back for redemption.

The risks for using this platform centers around the supply of miners willing to pay BTC to earn STX. This is reflected in network demand and adoption. The price volatility for STX is pretty standard for most crypto tokens, so you can imagine what happens in times of great stress in the market. If you deal with sBTC, there’s also smart contract risk to consider.

Bitcoin Finance (BTCFi)

Babylon Protocol

This category might not have gotten the attention and prominence if it were not for the Babylon Protocol*. For the first time, there’s a chance for Bitcoin to expand its use case aside from its status as digital gold and the payment method narrative.

What Babylon offers is the ability for other Proof-of-Stake chains to leverage the Bitcoin network as an additional security layer for themselves. Bitcoin hodlers lock up their BTC in their own wallets through the Babylon Genesis chain without the coins ever leaving the Bitcoin network. They earn yield in the form of the protocol’s BABY token that can be staked on the Genesis chain for further rewards. It is also a governance token with voting power that help shape the future of the network.

To stop staking, initiate a request through the website and wait approx. 7 days ( 1,080 Bitcoin blocks) before the coins are available for withdrawal.

The risks of staking with Babylon are that:

(i) A Vigilante Relayer needs to honestly inspect and verify the checkpoints submitted to the Babylon chain.

(ii) The Finality Provider, which is who you stake your coins with, needs to behave well instead of maliciously, so their stake (and yours!) don’t get slashed.

(iii) The protocol is still under development and we’re only now in phase 2. There’s still phase 3 to go, likely with more development ahead. Unforeseen issues could arise.

Lorenzo Protocol

Following the tradition of composable financing, aka, financial blocks, two other protocols have emerged to use what Babylon has done and put their own spin on things when it comes to yield.

Lorenzo’s business model is to collect BTC from interested parties and deposit them with Babylon. The BTC collected is then used by Babylon to secure the PoS chains. Meanwhile, Lorenzo will issue two types of tokens: stBTC (called Liquid Principal Tokens) representing your staked capital and YAT (“Yield Accruing Tokens”) which represents the yield you get for staking your BTC.

You can use stBTC on the SUI network through bridging to participate in DeFi activities. The YAT tokens can also be traded on Fractle Finance, but there are conditions attached to the trade, which won’t be covered here.

Lombard Protocol

Another protocol, Lombard, also do something similar but with their own twist.

Unlike Lorenzo, Lombard is one of the Finality Providers, and also partnered with 4 other institutional-grade Finality Providers to secure the network. The staked BTC will be directly staked with these providers, which is a more direct approach.

Lombard issues LBTC to stakers. This token is your claim to the staked BTC and also yield-bearing. Just like stBTC, you can use LBTC to earn yield or do other DeFi activity on the Lombard platform.

Crypto loves Legos, and the appeal of building one layer on top of another to maximize leverage has never wavered, despite the risks involved. However, these blocks look more like Jenga because all it takes is for one risk to then cause a cascading waterfall. Just the triple trust issue is enough to give me nightmares!

Triple Trust Requirements:

Users must trust Lorenzo / Lombard (custody of BTC)

Lorenzo / Lombard must trust Babylon (staking infrastructure)

Babylon must trust PoS chain validators (final execution)

Then there’s also:

Smart Contract risks

Token Depeg risk - when the liquid token value is lower than the collateral amount.

Centralization risk - limited number of Finality Providers

Yield risk - both obtain yield from Babylon, thus subject to demand for what Babylon offers. Babylon’s success/failure directly affects both protocols.

Mass exit risk - think bank run.

Here is a chart of yields I can find for Bitcoin staking:

By this time, I think I have sufficiently pointed out all the various pros and cons of staking BTC. It’s worth giving them a try in the spirit of exploration. Just make sure you only dabble with what you can afford to lose.

*Next week: My deep dive on Babylon Protocol (the $5.4 billion gorilla in the room). Subscribe to get it first, and leave a comment with any Babylon questions you want me to cover.

Sources:

https://www.okx.com/learn/what-is-bitcoin-staking

https://cointelegraph.com/news/can-you-stake-bitcoin-btc

https://www.valuewalk.com/cryptocurrency/bitcoin-staking/

https://www.coingecko.com/learn/what-is-bitcoin-staking

https://coinbureau.com/education/what-is-bitcoin-staking/

https://medium.com/@lorenzoprotocol/how-lorenzo-protocol-tokenizes-bitcoin-staking-cf61ddf67f66

https://lorenzo-protocol.gitbook.io/docs

https://docs.lombard.finance/bitcoin-staking-with-babylon

Also with assistance from Claude AI