How to DeFi: Lending

Maple Finance

Imagine a financial system that never closes, never asks for your credit score, and processes loans in minutes instead of weeks. Decentralized Finance (DeFi) lets you borrow, lend, and earn with crypto without any intermediaries like banks involved in the process.

Here's how it works differently from traditional banking:

When applying for a loan with a bank, they will review your credit history and approve or deny loans based on the information given. If you miss a payment, they will give you some time to catch up.

With a DeFi platform, you put up crypto (like Bitcoin or Ethereum) as collateral upfront. As long as you have enough collateral, you're automatically approved—no paperwork or credit checks needed.

But here's the catch: if you can't repay on time, the system immediately takes your collateral. No grace period, no phone calls, no second chances.

It's faster and more accessible than banks, but also less forgiving if things go wrong.

Lending on DeFi

Lending is one of the most common activities in Decentralised Finance. All you need to do is to deposit a sum of money onto a platform, and then watch your money grow.

Where you deposit your money and how much yield you can get from it is where your research bears fruit.

We talked about Maple Finance in our previous issue, and I thought: what better way to give the new tech a try than utilising it for my own experiments?

So here I am, dogfooding into my own research by lending some USDC to the Maple Finance platform.

Maple Finance

Quick Summary: Maple Finance is a DeFi platform where they lend funds to institutions. They have $3.59 billion assets under management and works with various known crypto companies such as Coinbase, Circle, and Galaxy Digital.

Institutional lenders get the white-glove service, need to do KYC, and a minimum of $100k to invest.

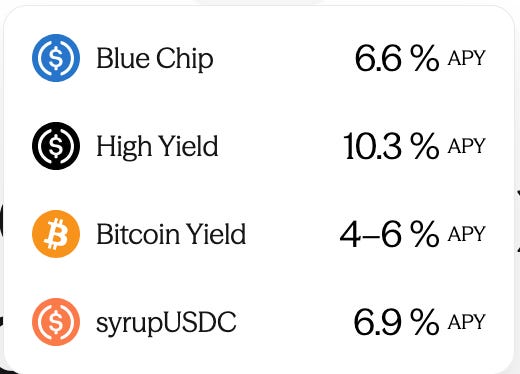

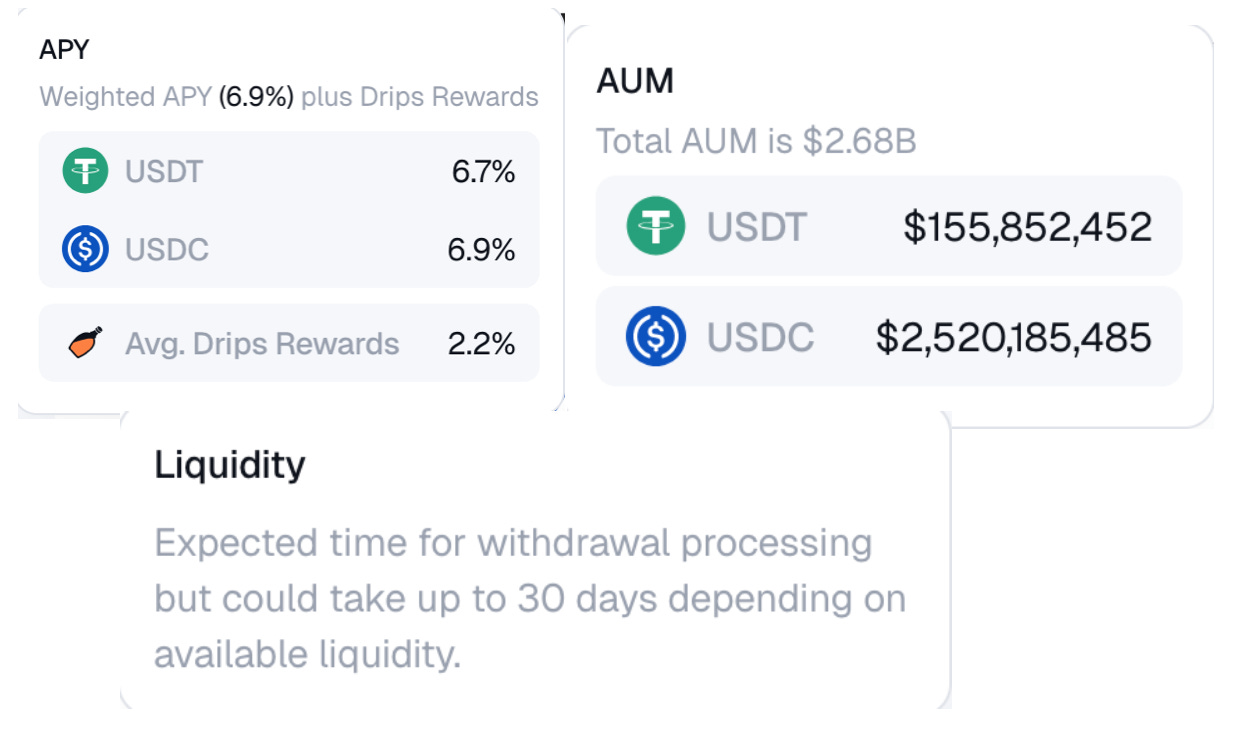

They also offer a Open Access version where you can earn up 6.9% APY yield, distributed in the form of syrupUSDC tokens. When you compare to the other types of yield for institutions, it’s pretty decent yield.

How Lending Works

First, we go to the webpage (https://app.maple.finance/earn).

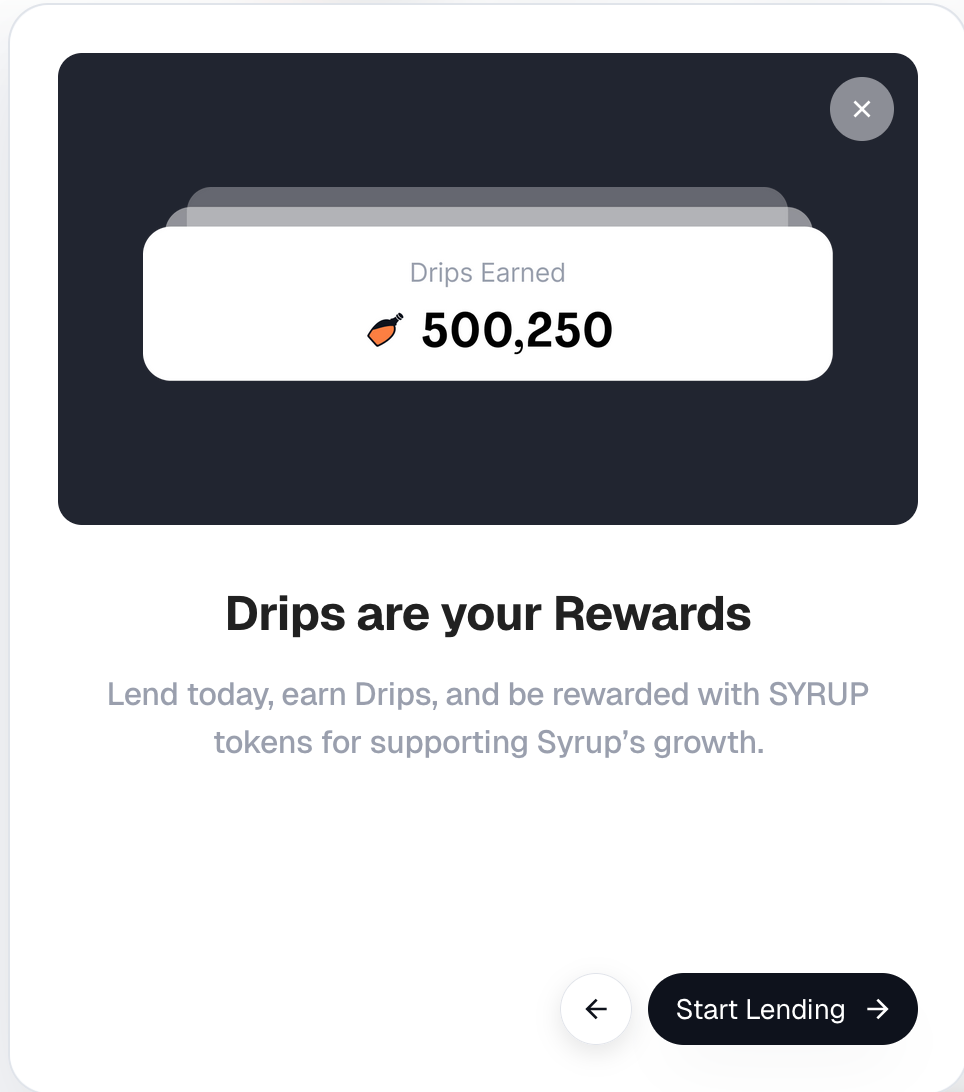

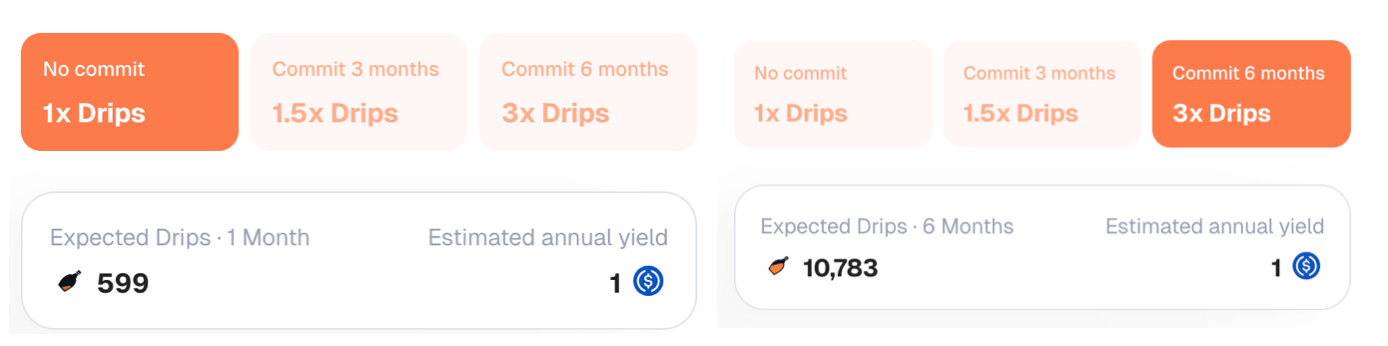

There will be some introductory information about the platform, including the rewards paid out, known as SYRUP tokens. Drips is an incentive program to boost your earnings.

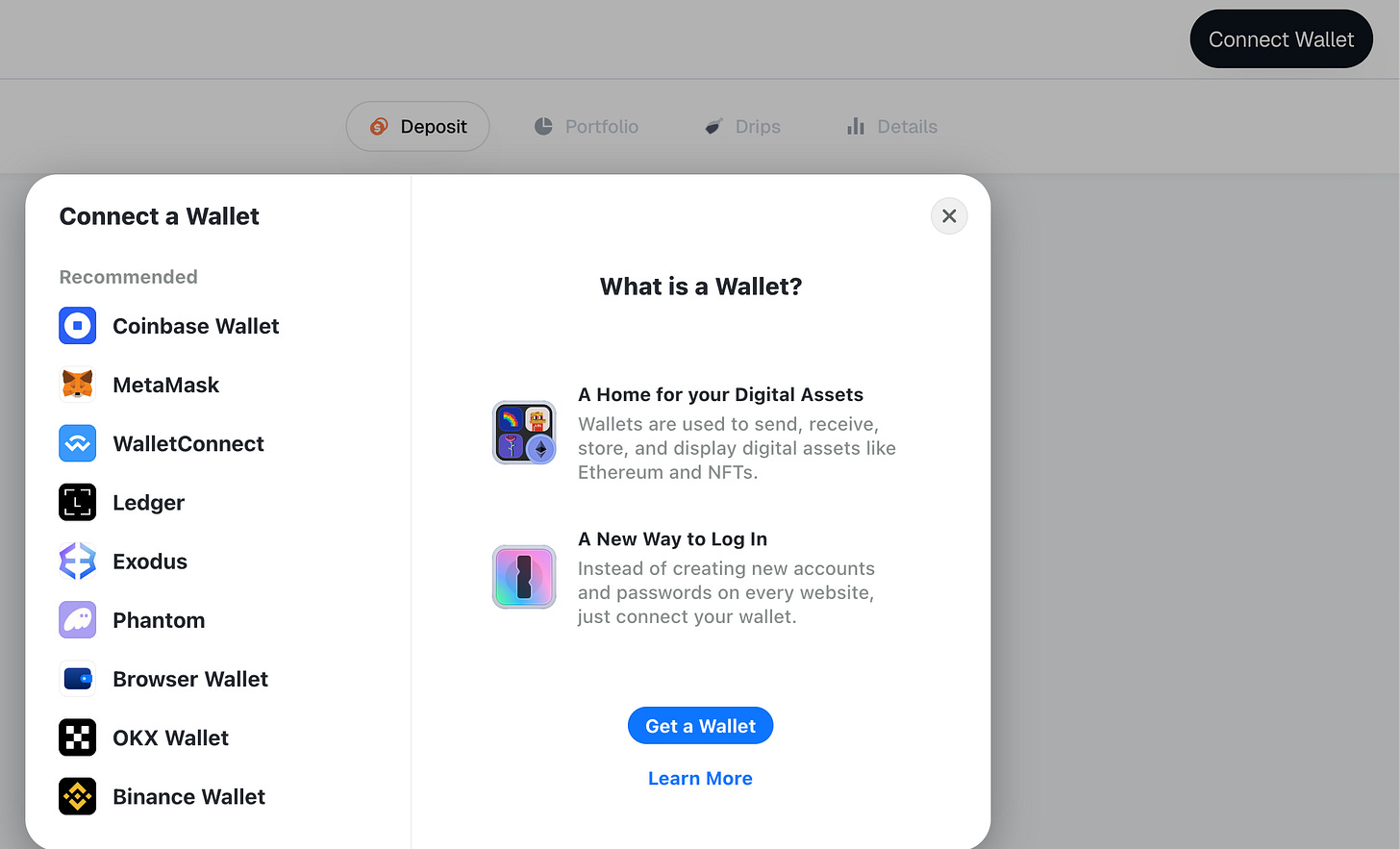

When you click on the Connect Wallet button on the top-right corner of the page, you can see a pop-up window of the wallets currently supported.

Based on the list of supported wallets, Ethereum, Solana and the Binance chain appears to be the blockchains supported for lending. The Drips program is only available on Ethereum, according to the documentation. Arbitrum is the latest blockchain to support syrupUSDC lending.

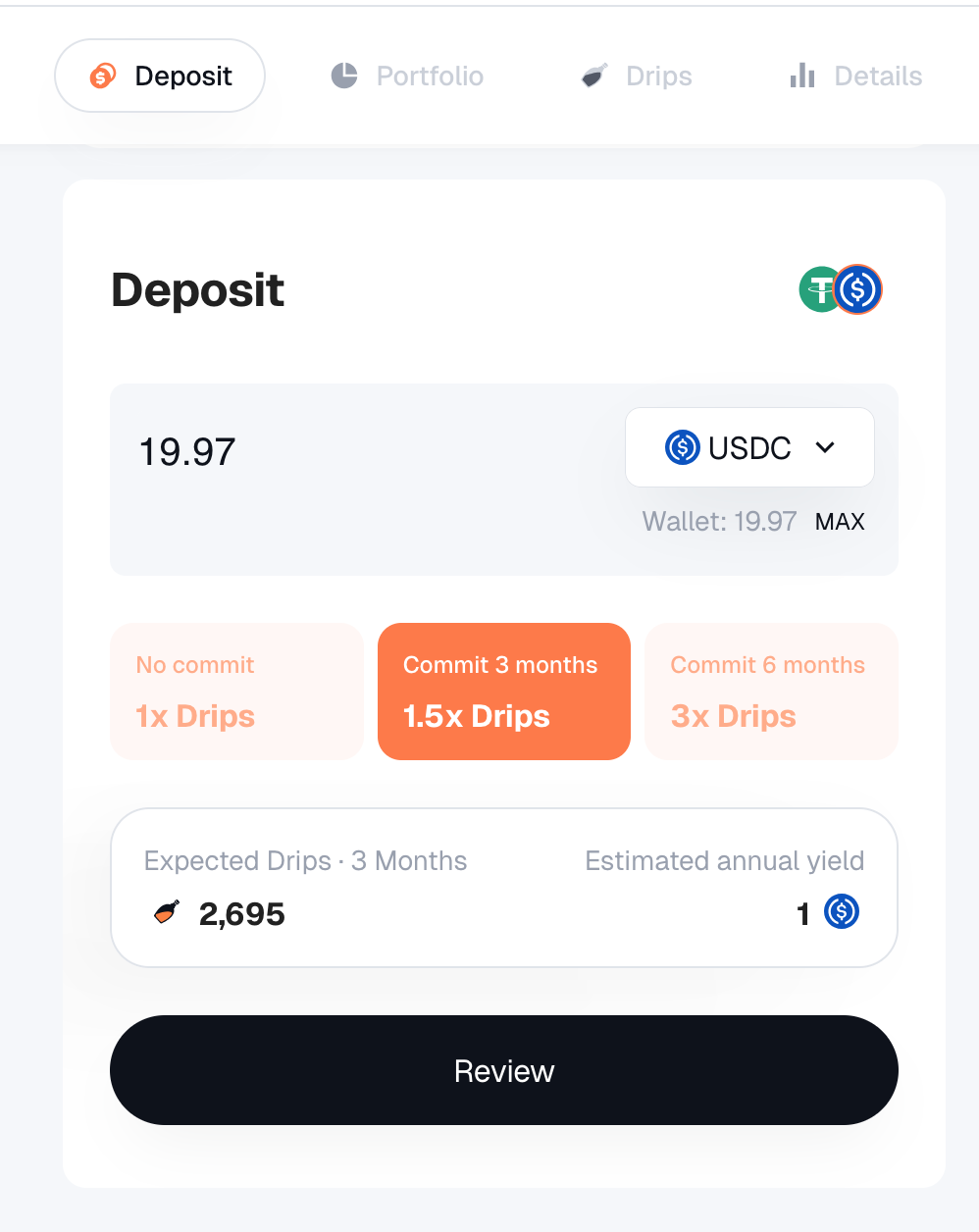

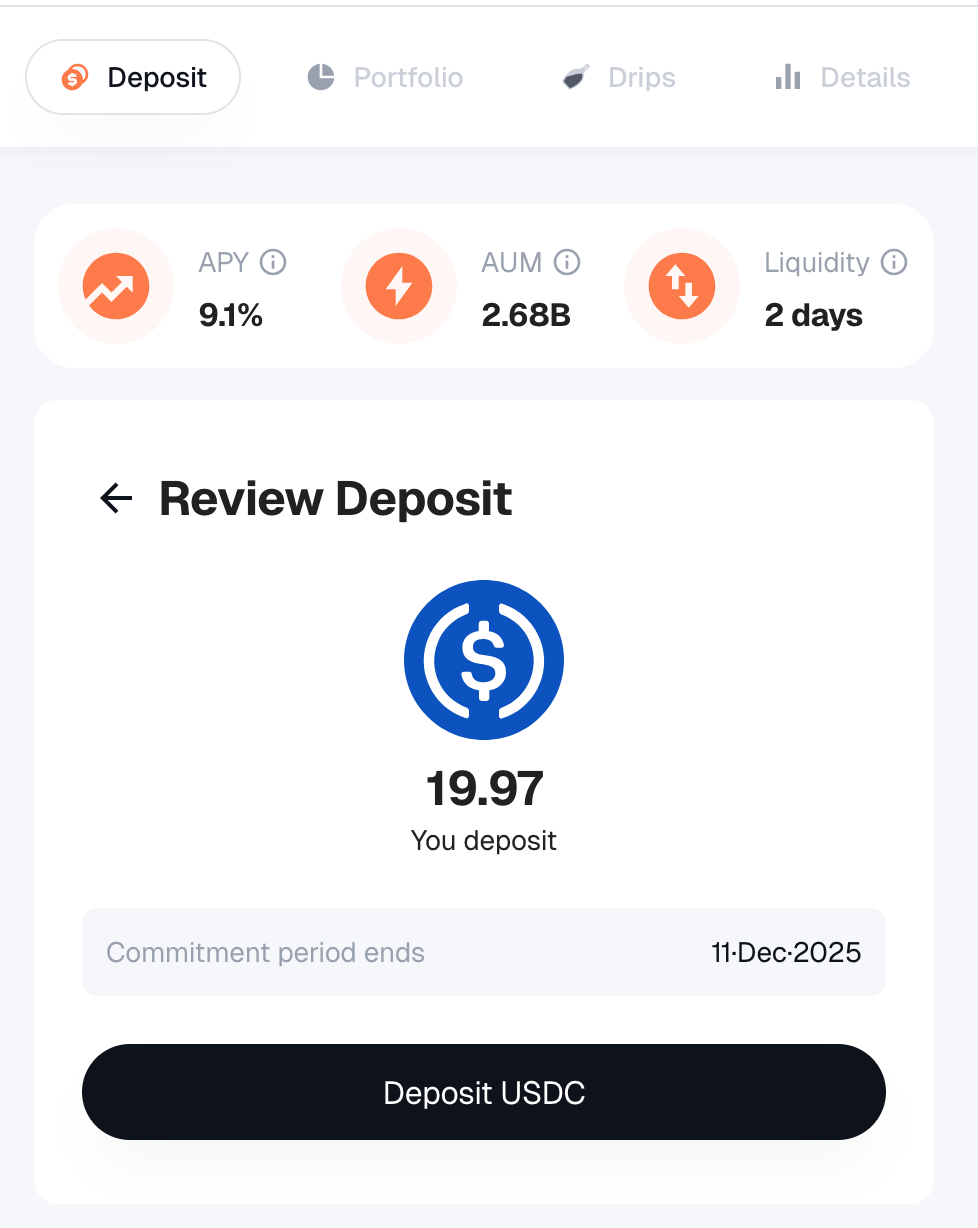

After the wallet is successfully connected, you enter the amount to lend to the platform. It accepts only USDC and USDT at this time.

Here’s what the other two options look like:

Click the “Review” button to proceed.

Here is a quick overview of what those three terms mean at the top of the page.

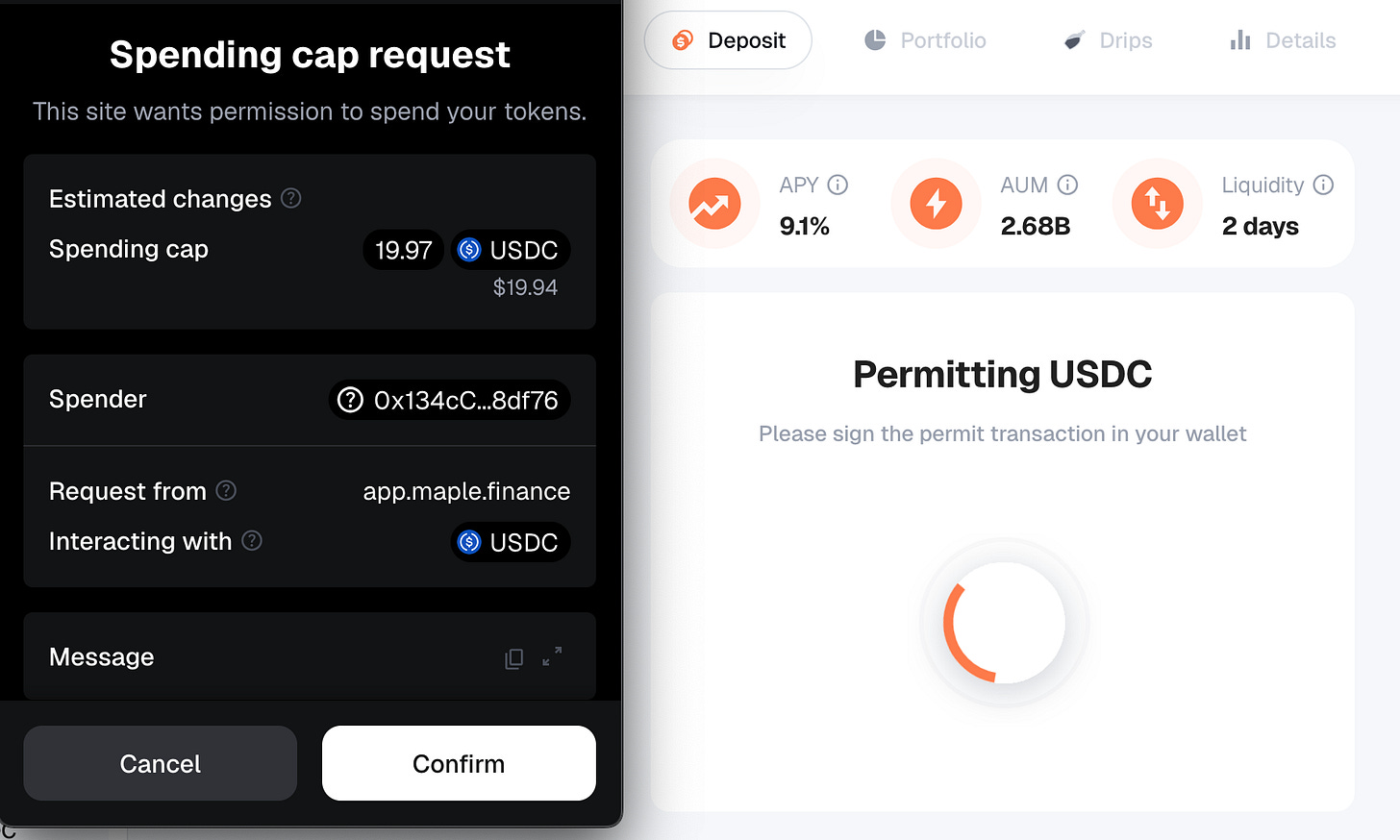

Select “Deposit USDC” to continue. You will be asked to allow the platform to access your wallet.

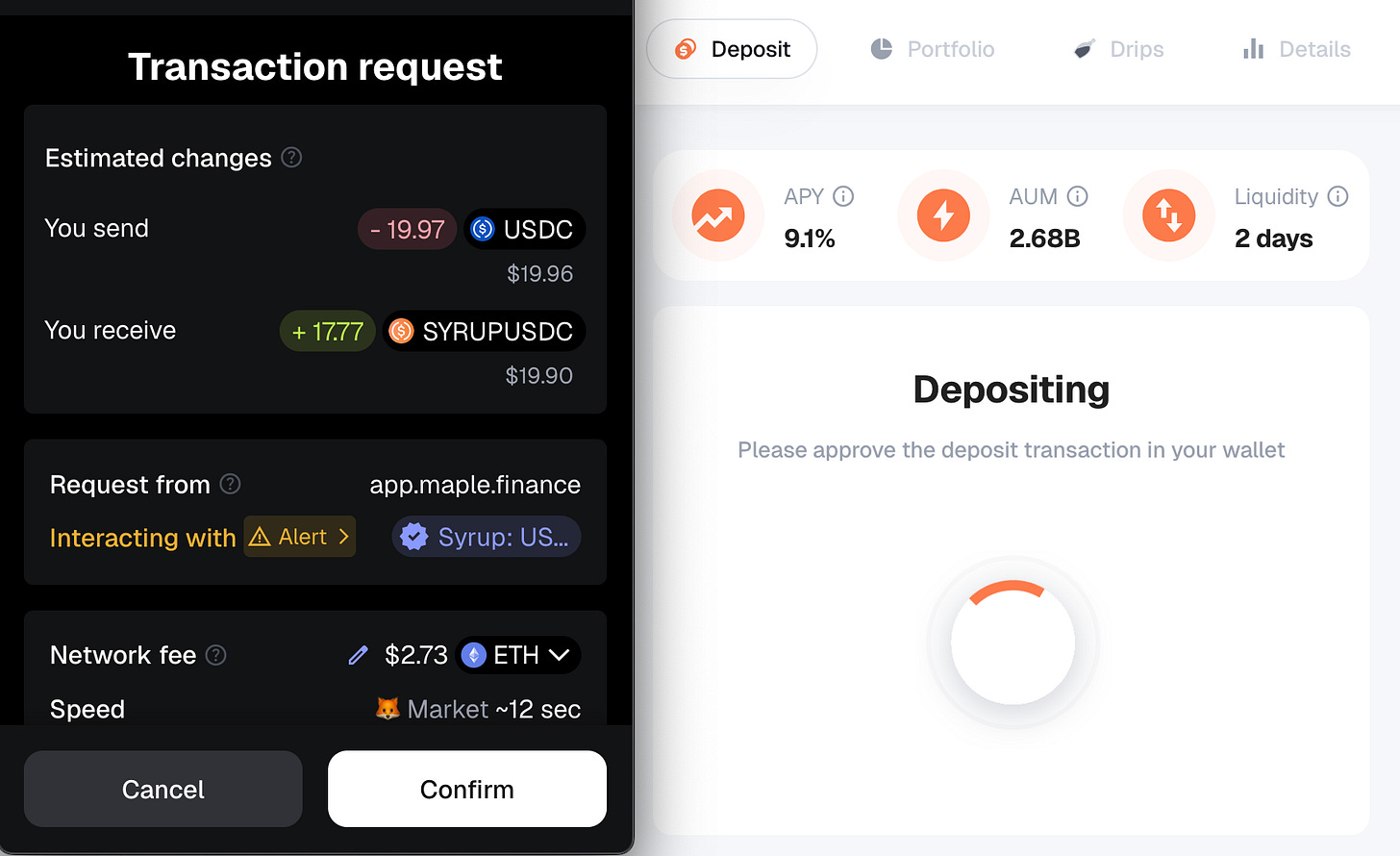

Once you’ve given permission, then you will be asked to confirm the transaction.

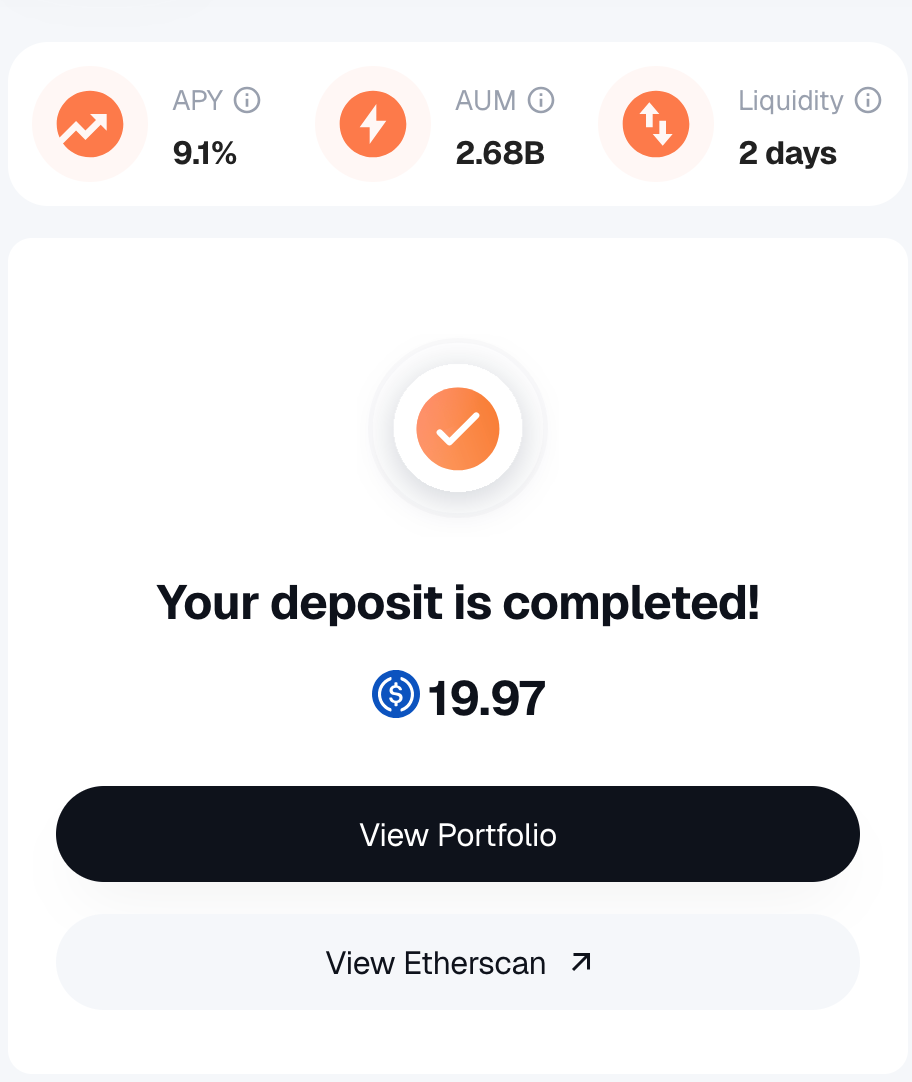

Check that all the details are valid before proceeding. The platform will let you know that your deposit is successful.

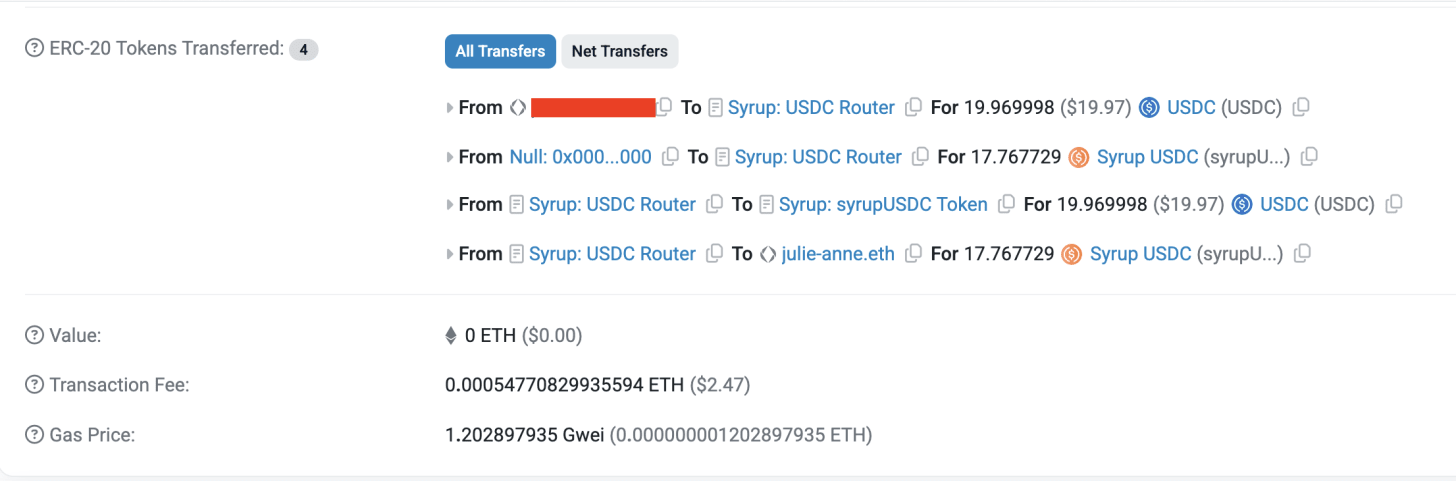

This transaction is now recorded on the blockchain. Select the View Etherscan button to check that all is correct.

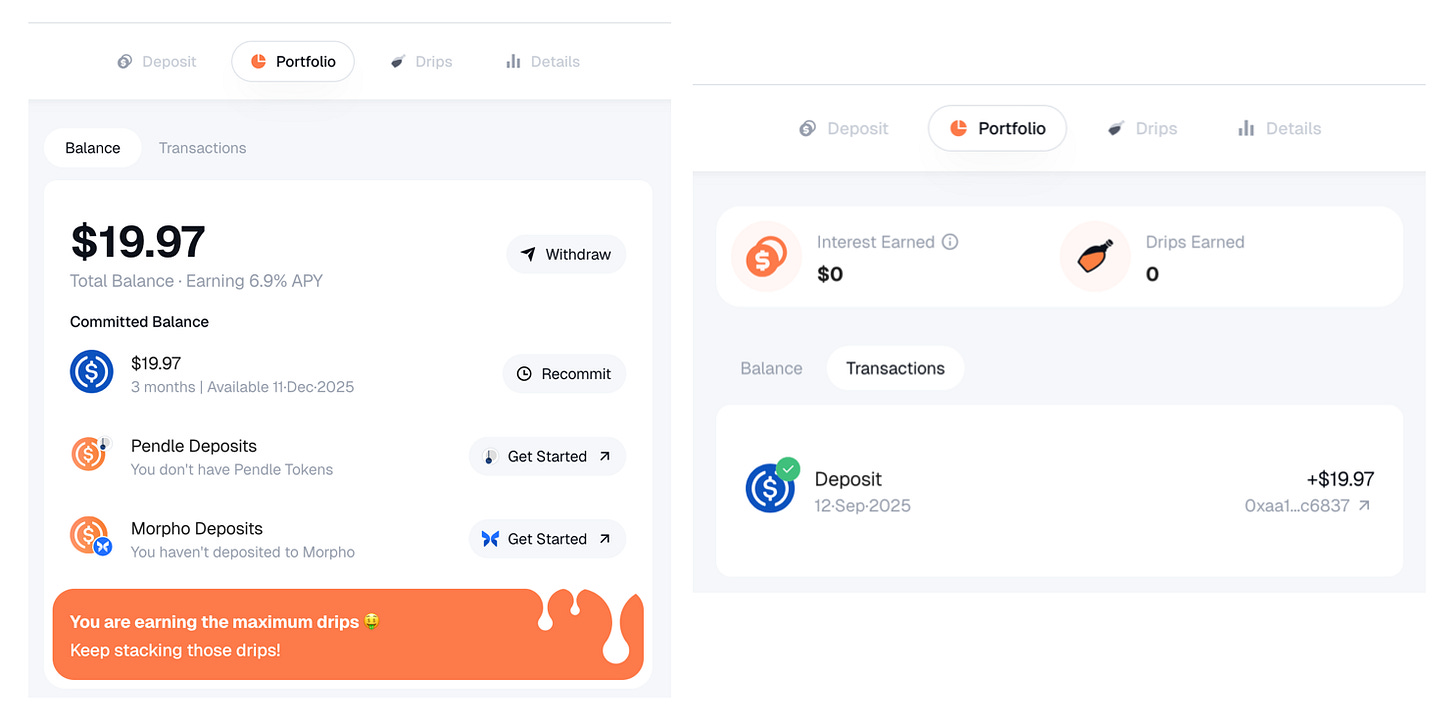

The View Portfolio button will show you what you have available.

Voilà! That is how you lend on a DeFi platform.

When you’re ready to withdraw, click the “Withdraw” button in the Portfolio page to make your request. Withdrawals are usually processed within 24 hours but may be as long as 30 days dependent on available liquidity.

There is also the option to swap the syrupUSDC tokens to regular USDC tokens on Uniswap if you don’t want waiting. We can address this in a future issue.

Conclusion

DeFi lending might seem complex at first glance, but as you've seen with Maple Finance, the actual process is surprisingly straightforward. Just connect your wallet and start earning yield on your crypto.

The key takeaway? DeFi trades traditional banking's flexibility for speed and accessibility.

Ready to dip your toes into DeFi lending? Start small with an amount you're comfortable with, choose a reputable platform like Maple Finance, and always research the borrowers and understand the risks before lending out your crypto.

Remember, higher yields often come with higher risks.

What's your biggest question about DeFi lending? Drop it in the comments below. And if this guide helped demystify the process for you, share it with someone who's been curious about crypto lending but didn't know where to start.