Dear readers,

In the previous issue, I’d shown how to stake SOL on Marinade Finance. This allows my staked SOL to have its liquidity unlocked in the form of mSOL. I can now use mSOL to find another way to earn additional yield.

The most important thing to remember is: if I don’t have mSOL, I won’t be able to unstake my SOL at Marinade Finance. So this second layer is adding more risk to my experiment. Exercise care in choosing this platform.

Disclaimer: This is most definitely NOT financial advice or any kind of recommendation to use the protocol. It’s purely out of my own self-interest and curiosity. I’m sharing this process in case you’re wondering what it looks like.

There are two ways to get the most out of mSOL: through Marinade Finance itself or another DeFi platform within the Solana ecosystem.

Within Marinade Finance

Deposit, Supply or Add liquidity with mSOL to earn yield.

If I choose the Deposit option, aka ‘farm’, I get MNDE tokens - governance tokens that gives me a say in the direction of Marinade Finance.

With Other DeFi Protocols

Instead of putting all my eggs in one basket, so to speak, I can also choose to deposit mSOL into other DeFi protocols. Note that the plain option of just depositing without the ability to earn MNDE tokens yields a higher APY.

The protocols currently interacting with mSOL include Synthetify, Solend, Saber, Raydium, Port, Orca, Larix, Francium, Atrix and Aldrin.

Based on the chart above, I would keep my options to those above $100 million in TVL. Even if the TVL numbers are likely not the most accurate measurement metric, it’s still better than nothing. This is the first pass, so to speak. That narrows my options down to Solend, Raydium and Atrix.

The fact that I can’t find any information on the official Solana.com website for Atrix at the time of writing is slightly worrisome. The other two, Solend and Raydium, are definitely well-known in the Solana community.

Looking closer at what is offered on each protocol, I noticed that both Raydium and Atrix only offer liquidity pool options. This means I need to deposit a pair of assets to get LP tokens. The no. 1 risk with liquidity pool providing is impermanent loss. Even if one of the assets is a stablecoin, like mSOL-USDC offered by both, the risk is still higher than single-staking like Solend.

Lending mSOL on Solend

I know my own risk appetite, and I think Solend is as far as I go. The APY is a bit conservative compared to the rest but this is the 2nd-layer risk, and I’m not here to super-maximize every bit of yield I have.

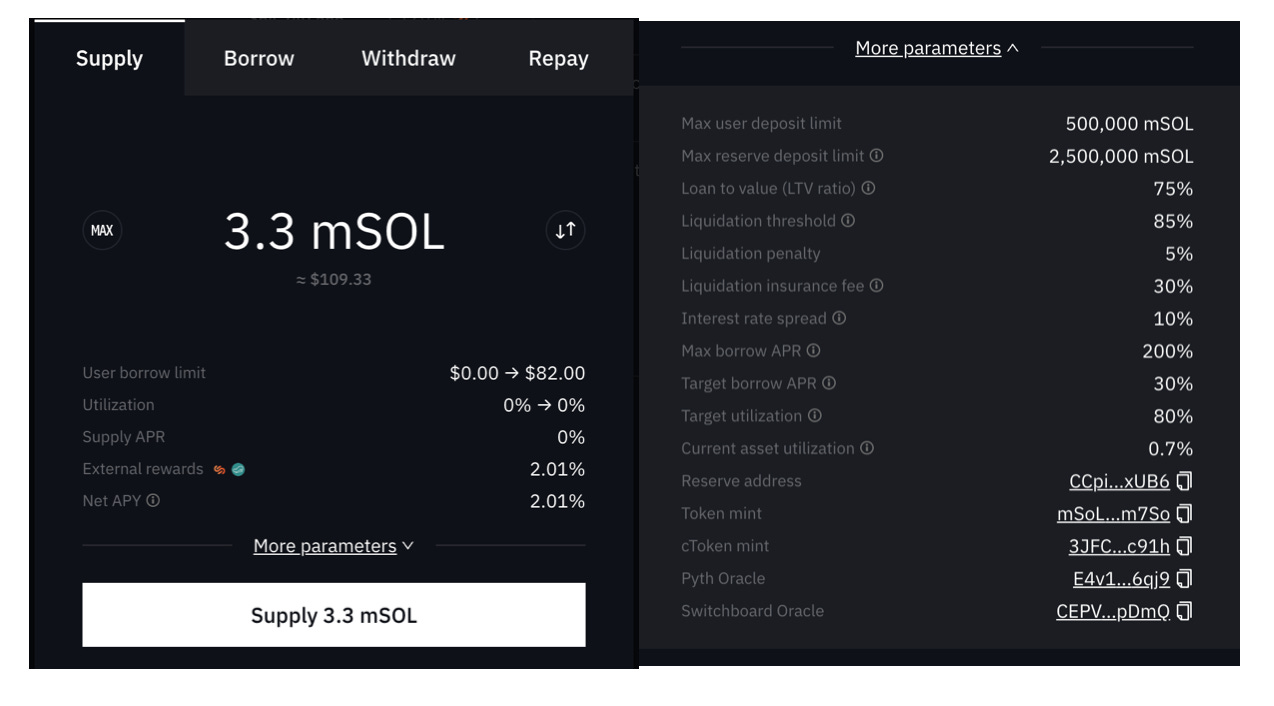

Clicking on the Supply/Borrow button on Solend brings me to their webpage and mSOL liquidity pool.

Let’s take a look at some of the details here:

LTV - Loan-to-value. This means I can borrow up to 75% of the value deposited.

Total Supply - how much mSOL is in the pool.

Supply APY - I get 0.40% in Solend’s native token SLND and 1.61% of MNDE instead of more mSOL. This makes sense as more mSOL can’t be minted by Solend.

Total Borrow - how much is borrowed from the pool. Less than 1% has been borrowed.

Before committing tokens to Solend, let’s take a quick comparison with what’s offered by Marinade Finance:

Being the cautious person I am, I decided to do both :)

I split half of my mSOL with Marinade Finance and get the MNDE tokens. I’ll mint a NFT which gives me voting rights on governance proposals.

I encountered an error with the minting process. Oh no, what’s happening?

Turns out I don’t have enough SOL to complete the transaction. So I deposited 1 SOL into the wallet, and it worked.

After the transaction was approved, I got my minted NFT that gives me voting eligibility on Marinade Finance.

Supplying to Solend

After having succeeded in getting this settled with Marinade Finance, I move on to another part of my experiment, which is supplying the remaining mSOL with Solend.

But even in this platform, I also encountered an error:

Same problem: not enough SOL. With that additional SOL added, I now have enough to process this transaction too.

Conclusion

I’ve now successfully used two DeFi protocols in the Solana ecosystem. :) Next issue, we will look at another protocol that helps you monitor all the DeFi activity on Solana. This is quite useful if you dabble in more than I have and just want one place to see everything in one go. ‘Til next time!

As always, please feel free to share this with others who might have an interest in this topic.

Looking forward to your comments and ideas for future issues.